Safe Money Investments

What Are Safe Money Investments?The definition of “a safe money investment” is money you cannot afford to lose.I believe that the money you’ve saved for retirement (or are currently saving for retirement) is money you can’t afford to lose. So I’m going to show you the best place to save money without risk. Let me give you two scenarios. In the first one you faithfully save for retirement each month, and all your money is at risk in the market. It goes up and down, and you have no idea what it will do month to month or year to year. You hope years later you’ll have more than you contributed. In the second , you save for retirement each month, but none of your money is ever at risk in the market. In grows nicely over time, but it never goes down in value. Not ever! Which would you choose?

Which would you choose? It’s a no brainer! Of course you don’t want your money at risk. Of course you want your nest egg to grow and never go down in value. But most people have their money at risk. And what happens when the next recession or market down turn occurs? And it will occur. Why do people put their hard earn retirement dollars at risk. Why do YOU do it? I believe it’s because people just don’t know any other way to save for retirement. They’ve been told that in order to get a good return on your money, they need to put it at risk. No risk, no return as the saying goes. That’s simply not true. There are ways you can dependably save for retirement, receive a good return on your money, and never see it go down in value. When it comes to your retirement money, this is how the bulk of your money should grow…no risk, good return. You want to make sure that after decades of saving for retirement, you WILL have a nice nest egg, and nothing can happen, near your time to retire, that will jeopardize that money.

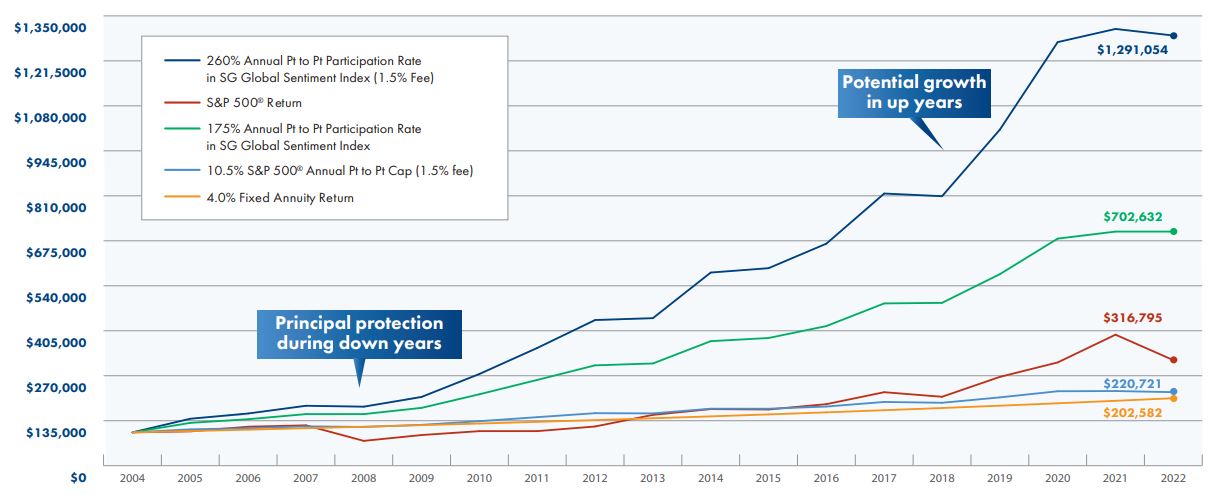

Don’t ever let that happen to you! What’s the Alternative?The first alternative is a specifically designed cash value life insurance policy using the Infinite Banking Concept, or the L.I.R.P. (Life Insurance Retirement Plan). I won’t go into a lot of details here because you can learn more on the other pages of this website. You need to learn about it. It pays you income TAX-FREE in retirement. The second alternative is a Fixed Annuity. What is it? I’m glad you asked. It’s a financial instrument issued by an insurance company that preserves your money and grows it for the future…without any risk. Here’s a brief explanation. Fixed annuities can work like a CD. You put money in and earn a declared interest rate. The insurance company may say, as an example, they will pay you 4% a year for the next five years…compounding interest. The money grows tax deferred. There aren’t any fees and your earnings are guaranteed. With market based investments, you have fees and there aren’t any guarantees. Now read this carefully. A fixed annuity can also be tied to a market index. It’s then called a fixed index annuity. Instead of the insurance company saying they will pay you a fixed amount of interest every year, they will tie your returns to a stock market index. While your money IS NOT EVER in the market, you can receive substantially higher returns. So if you have a fixed index annuity with a 10% cap, it means that you will receive whatever that index gives you up to 10%. If the market does 10%, you receive 10%. If the market does 3%, you receive 3%. If the market index drops 20%, your account value stays the same. It can’t go down. You see, your account can only go up or stay the same. What if the insurance company says they will give you a percentage of what the market does with no cap on the upside? So if the market does 15%, and the insurance company says they will give you 150% of that, you would then receive 22.5% that year. Remember, no risk, no fees. Just pure growth…compounding growth. And those gains are locked in so you can never lose that money. These accounts lock in every year, or two years, depending on which one you choose. So when the market is recovering for two or three years from a huge drop, and most people are waiting just to break even, your account goes up each year. BIG UPDATE FOR 2023….Because of recent changes, some fixed indexed annuities with very strong insurance companies are paying over 200% of the index return. In other words, if the market index being used returns 10% that year, you will receive over 20% interest added to your account! All with no risk and no fees….using powerful true compounding interest. And if you are willing to pay a fee, you can triple or quadruple your return!!! There is no better way to grow assets or even create a legacy for your heirs. Remember, money in annuities passes to your heirs probate free. Here’s a VERY important question to consider. If you went 20 years and your account went up when the market went up and stayed put when the market dropped, and then went back up when the market started to recover, how well would your account grow? Think about it. Here’s an illustration showing how a fixed indexed annuity can work. It shows a $100,000 account from years 2004 to 2022. The red line shows the money in the market with the S and P 500 index. The account value in 2022 is $316,795. Look at the green line. It shows the money in a fixed indexed annuity using a no fee index offered by the annuity. The return is tied to that index return, but the money IS NOT in the market. The account value is $702,632! That’s receiving 175% return of the index each year. NOW…look at the blue line. This is where the client elected to pay an annual fee of 1.5%. That gives the client a 260% return on the index. The account value is $1,291,054!!!

Please tell me why would you ever want to put your retirement money in the market at risk when you have the possibility to receive a better return without risk of loss. It makes no sense. Speculate in the market if you want, BUT not with your retirement savings. What I’ve just explained is something your typical financial advisor won’t tell you about. Why? Because they can’t charge you a fee. They will unethically tell you there’s no alternative to putting your money at risk. Watch this video for proof. It will blow your mind! The truth if finally out. How Do I Get PaidWhen you follow one of my recommendations, I get paid a commission. You have some self righteous advisors in the market, and some ill informed talking heads, that will tell you I don’t care about you. That I just want to collect my big commission and “See you later”. That would be another lie. Fee only advisors make more money than commission advisors, truth be told. And they give you no guarantees. Just trust them. You lose money, which happens often enough, and they still get paid. I stay with you for years, and you never lose a dime. For 20 years I had all my investment licenses and even collected a fee for handling accounts. I’ve been in that world. So I know what goes on in that world. I’ll never look you in the face and tell you it’s OK that your account has gone down 20%. “Don’t worry, the market will recover and you’ll be just fine”. That advisor may or may not have your interest at heart, but one thing is for sure, he doesn’t want you to move your money because then he will lose his fee. And that can’t happen. I will show you how to create your own Personal Pension Plan so that you never stress about your retirement money again, while enjoying nice dependable growth. What Do I Do NowBottom line is this. You have a choice. Leave all your money in the market at risk (even bonds funds can be risky), or move the bulk of your nest egg into a safe money investment, guaranteed never to lose it. Grow your money without stress, and never wonder what will happen to your money when you get ready to retire. And don’t forget, fixed annuities will pay you an income for life no matter what…an income that can never go down. That is certainly not the case with money in the market. Contact me to learn more. Or schedule a consultation with me HERE. You owe it to yourself to know the truth.

|

|

Let’s say your retirement money is in an old 401K from your previous employer, or you rolled it over to an IRA. Take your pick 1)…all the money is in the market at risk going up and down with no idea what it will do month to month, year to year. Or 2)…all the money grows nicely and it never goes down in value…not ever. You would know that in the future you’d have a nice nest egg without risk or worry, guaranteed.

Let’s say your retirement money is in an old 401K from your previous employer, or you rolled it over to an IRA. Take your pick 1)…all the money is in the market at risk going up and down with no idea what it will do month to month, year to year. Or 2)…all the money grows nicely and it never goes down in value…not ever. You would know that in the future you’d have a nice nest egg without risk or worry, guaranteed.  In 2008 millions of Americans saw their 401Ks, IRAs, and other retirement accounts invested in the market, drop 30 to 50 percent. And so many of them wanted to retire that year or in the next couple years. What do you think happened to their retirement. Gone. It takes years to recover from that.

In 2008 millions of Americans saw their 401Ks, IRAs, and other retirement accounts invested in the market, drop 30 to 50 percent. And so many of them wanted to retire that year or in the next couple years. What do you think happened to their retirement. Gone. It takes years to recover from that.

0 Comments on “Safe Money Investments”